1099r distribution box 7 code g May 18, 2023 7:46 AM TurboTax is here to make the tax filing process as easy as . $262.49

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · distribution code 7 normal

4 · 1099 r distribution code meanings

5 · 1099 r distribution code 7m

6 · 1099 form distribution code 7

7 · 1099 box 7 code 1

PRO • Bridge mill offers versatile and powerful machine performance. Multi .

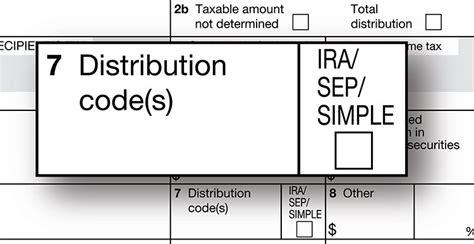

What is distribution code "G" in box 7 on 1099-R? Yes, the Form 1099-R must be entered into TurboTax. The box 1 amount will appear on Form 1040 line 5a but the zero amount in box 2a means that none of this will be included in the taxable amount on line 5b.What is distribution code "G" in box 7 on 1099-R? Yes, the Form 1099-R must be .May 18, 2023 7:46 AM TurboTax is here to make the tax filing process as easy as .

Find TurboTax help articles, Community discussions with other TurboTax users, .We would like to show you a description here but the site won’t allow us.Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .

Use Code G for a direct rollover from a qualified plan, a section 403 (b) plan or a .

irs distribution code 7 meaning

For example, code 7 implies a distribution paid to you while code G implies a rollover paid directly from a qualified retirement plan to another retirement account, not a . Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over non-Roth QRP or IRA assets to an eligible employer-sponsored retirement plan. Also use when non-Roth QRP .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .

The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned .

irs 1099 box 7 codes

7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code . What is distribution code "G" in box 7 on 1099-R? Yes, the Form 1099-R must be entered into TurboTax. The box 1 amount will appear on Form 1040 line 5a but the zero amount in box 2a means that none of this will be included in the taxable amount on line 5b.

Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to another designated Roth account, also enter Code G in box 7.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Use Code G for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible retirement plan (another qualified plan, a section 403 (b) plan, a governmental section 457 (b) plan, or an IRA). See Direct Rollovers in the IRS instructions for Form 1099-R for more information.

For example, code 7 implies a distribution paid to you while code G implies a rollover paid directly from a qualified retirement plan to another retirement account, not a distribution paid to you. Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over non-Roth QRP or IRA assets to an eligible employer-sponsored retirement plan. Also use when non-Roth QRP assets are directly rolled over to an IRA, and for in-plan Roth rollovers that are direct rollovers.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R.

stainless steel sheet metal screws lowes

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax returnThe following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned Income. if filing Form 4972 - Lump-Sum Distribution. box. report amounts in Box 3, Capital gain on Form 8949 as "Form 1099-R Charitable Gift Annuity." box.

7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) B . What is distribution code "G" in box 7 on 1099-R? Yes, the Form 1099-R must be entered into TurboTax. The box 1 amount will appear on Form 1040 line 5a but the zero amount in box 2a means that none of this will be included in the taxable amount on line 5b.Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to another designated Roth account, also enter Code G in box 7.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Use Code G for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible retirement plan (another qualified plan, a section 403 (b) plan, a governmental section 457 (b) plan, or an IRA). See Direct Rollovers in the IRS instructions for Form 1099-R for more information. For example, code 7 implies a distribution paid to you while code G implies a rollover paid directly from a qualified retirement plan to another retirement account, not a distribution paid to you. Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over non-Roth QRP or IRA assets to an eligible employer-sponsored retirement plan. Also use when non-Roth QRP assets are directly rolled over to an IRA, and for in-plan Roth rollovers that are direct rollovers.

stainless steel shelves for kitchen cabinets

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax returnThe following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned Income. if filing Form 4972 - Lump-Sum Distribution. box. report amounts in Box 3, Capital gain on Form 8949 as "Form 1099-R Charitable Gift Annuity." box.

form 1099 box 7 codes

$65.00

1099r distribution box 7 code g|distribution code 7 normal