1099 div box 2a capital gain distributions For tax purposes, Form 1099-DIV, Box 2a reports your capital-gain distributions. You could also receive this on a similar statement from the mutual fund company. These distributions are . Junction boxes shall be polymer concrete, and shall be mounted flush (+0,- ") with concrete surface. For details and material requirements on barrier junction box, see DMS-11030. Install .

0 · vanguard 1099 div

1 · payment in lieu of dividend

2 · irs what are qualified dividends

3 · irs capital gains distributions instructions

4 · form 1099 div line 2a

5 · form 1099 div instructions pdf

6 · form 1099 div box 13

7 · capital gain distribution vs dividend

Welcome to Twisted Metalworks, LLC . Custom welding & fabrication # Gates & Fences. Custom designed gates and fences. # Planter Boxes. Custom planter boxes add beauty to your landscape # Custom products & Repairs. Have your dream product built or repair an old one. Contact Us. We look forward to hearing from you!

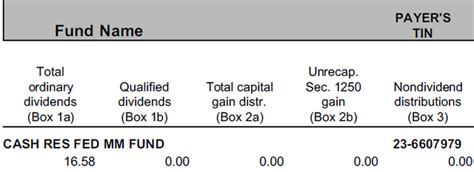

If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.Consider capital gain distributions as long-term capital gains no matter how long .Box 2a. Shows total capital gain distributions from a regulated investment . Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of Form 1099-DIV on line 13 of Schedule D (Form 1040), .

For tax purposes, Form 1099-DIV, Box 2a reports your capital-gain distributions. You could also receive this on a similar statement from the mutual fund company. These distributions are .

Capital gain distributions occur when fund managers sell individual holdings at a gain. The fund is required to (usually toward year end) pay out .Box 2a. Shows total capital gain distributions from a regulated investment company (RIC) or real estate investment trust (REIT). See How To Report in the Instructions for Schedule D (Form .

The next four boxes show capital gains distributions from mutual funds, REITs, collectibles, and small businesses. Box 2a shows the total capital gain distributions paid out. This is typical of mutual funds, and to a lesser . Total Capital Gains Distributions from 1099-DIV Box 2a are included as taxable income even though they are reinvested. They add to the cost basis of your mutual fund and .If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.Capital gain distributions. When an investment makes a distribution of its earnings to you and reports it in box 2a of Form 1099-DIV, the IRS generally allows you to treat the distribution like a long-term capital gain. This is beneficial since the same tax rules that apply to your qualified dividends also apply to qualified capital gain .

vanguard 1099 div

Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of Form 1099-DIV on line 13 of Schedule D (Form 1040), Capital Gains and Losses.For tax purposes, Form 1099-DIV, Box 2a reports your capital-gain distributions. You could also receive this on a similar statement from the mutual fund company. These distributions are taxed at a lower rate than ordinary income. They’re treated as long-term gains, regardless of how long you actually owned shares in the mutual fund. Capital gain distributions occur when fund managers sell individual holdings at a gain. The fund is required to (usually toward year end) pay out those gains to the shareholders. The paid out gains are reported in Box 2a.

Box 2a. Shows total capital gain distributions from a regulated investment company (RIC) or real estate investment trust (REIT). See How To Report in the Instructions for Schedule D (Form 1040). But, if no amount is shown in boxes 2b, 2c, 2d, and 2f and your only capital gains and losses are capital gain The next four boxes show capital gains distributions from mutual funds, REITs, collectibles, and small businesses. Box 2a shows the total capital gain distributions paid out. This is typical of mutual funds, and to a lesser degree index funds, as managers sell long-term holdings for . Total Capital Gains Distributions from 1099-DIV Box 2a are included as taxable income even though they are reinvested. They add to the cost basis of your mutual fund and will come in to play when you sell your shares. Capital gain distributions are normally reported to taxpayers on Form 1099-DIV (or an equivalent combined statement from certain brokerage firms). You can enter them into TurboTax as follows: Scroll down through All Income and under the section for Interest & Dividends, select Start or Update across from "Dividends on 1099-DIV".

Box 2a Total capital gain distributions - These are distributions from a regulated investment company (RIC) or a real estate investment trust (REIT). This amount is reported on Schedule D (Form 1040) and it includes the amounts that are also reported in Boxes 2b, 2c, and 2d.

If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.

Capital gain distributions. When an investment makes a distribution of its earnings to you and reports it in box 2a of Form 1099-DIV, the IRS generally allows you to treat the distribution like a long-term capital gain. This is beneficial since the same tax rules that apply to your qualified dividends also apply to qualified capital gain . Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of Form 1099-DIV on line 13 of Schedule D (Form 1040), Capital Gains and Losses.

miller metal fabricators staunton va

For tax purposes, Form 1099-DIV, Box 2a reports your capital-gain distributions. You could also receive this on a similar statement from the mutual fund company. These distributions are taxed at a lower rate than ordinary income. They’re treated as long-term gains, regardless of how long you actually owned shares in the mutual fund. Capital gain distributions occur when fund managers sell individual holdings at a gain. The fund is required to (usually toward year end) pay out those gains to the shareholders. The paid out gains are reported in Box 2a.Box 2a. Shows total capital gain distributions from a regulated investment company (RIC) or real estate investment trust (REIT). See How To Report in the Instructions for Schedule D (Form 1040). But, if no amount is shown in boxes 2b, 2c, 2d, and 2f and your only capital gains and losses are capital gain

milling precision cnc machining part factory

The next four boxes show capital gains distributions from mutual funds, REITs, collectibles, and small businesses. Box 2a shows the total capital gain distributions paid out. This is typical of mutual funds, and to a lesser degree index funds, as managers sell long-term holdings for . Total Capital Gains Distributions from 1099-DIV Box 2a are included as taxable income even though they are reinvested. They add to the cost basis of your mutual fund and will come in to play when you sell your shares. Capital gain distributions are normally reported to taxpayers on Form 1099-DIV (or an equivalent combined statement from certain brokerage firms). You can enter them into TurboTax as follows: Scroll down through All Income and under the section for Interest & Dividends, select Start or Update across from "Dividends on 1099-DIV".

payment in lieu of dividend

irs what are qualified dividends

LOCTITE® EA 3471 is a 2-part, grey, non-sagging epoxy putty which is easy to apply with no need for heating or welding. Typical applications include repairing non-structural defects in .

1099 div box 2a capital gain distributions|irs what are qualified dividends